E Tutorial For Tds Correction Return

E- Tutorial for Online Challan Correction. CBDT Income Tax NSDL TCS TCS certificates TDS TDS certificates TIN NSDL Traces challan Conso File TDS Traces Un-Matched Challan.

Tds On Rent 194ib And 194i Flow Chart Flow Chart Rent Individuality

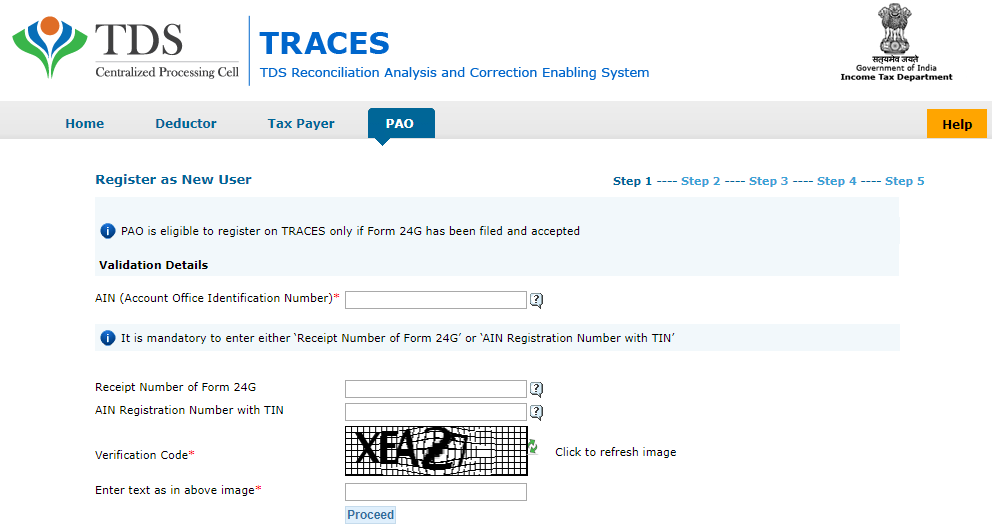

Steps for TDS correction return filing.

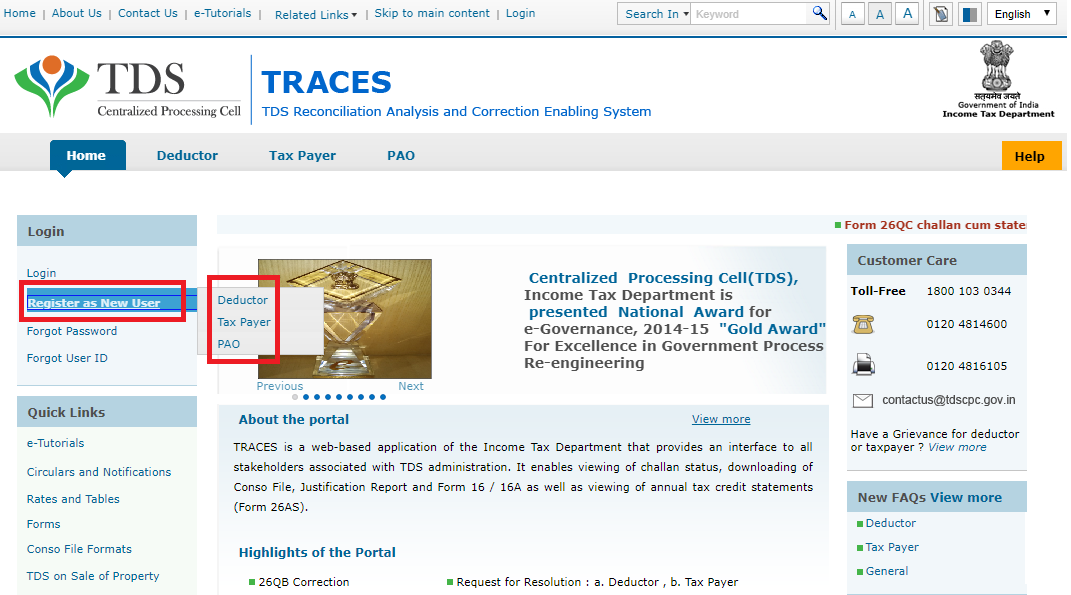

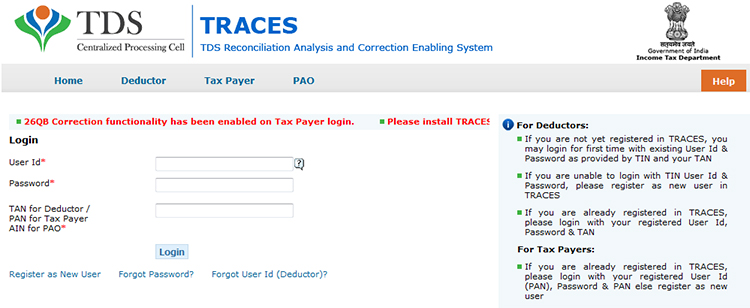

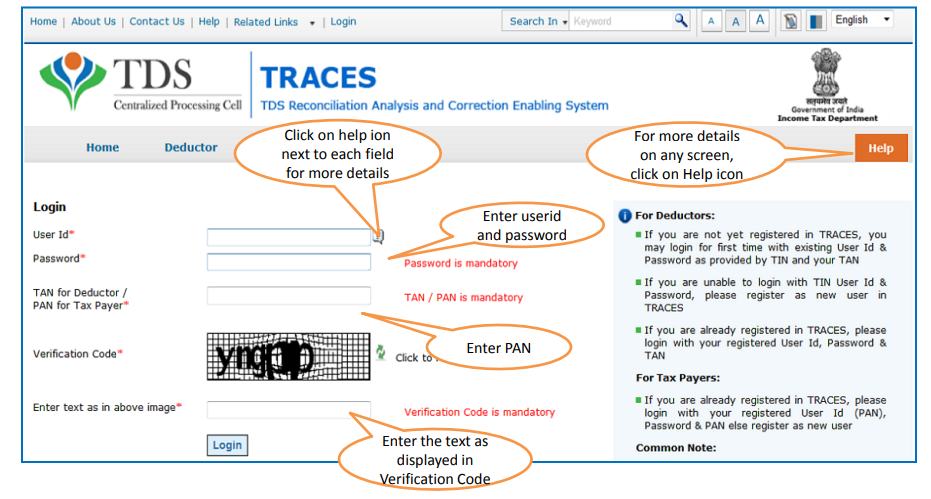

E tutorial for tds correction return. Firstly Login to TRACES website. Checking can be possible through Quarterly Statement Status after 3 working days of return filing. Used for preparing quarterly e-TDSTCS Statements.

Correction category should be Online. TRACES has provided an e- Tutorial on its website for queries where Conso-file is NA due to un-matched Challan. TDS Correction can be done in two ways.

Financial Year Quarter and Form Type correction category and latest token number click on Submit Request to raise the request Request can be submitted only if there is a regular statement filled and processed. For Form 24Q 26Q 27Q 27EQ Regular Correction for Financial Year 2007-08 onwards. The prescribed data structure can be downloaded from.

Filing of online correction is not possible if the regular statement previously filed as a paper return. Steps for TDS correction return filing. It is not mandatory to use NSDL e-Gov RPU for preparation of quarterly TDSTCS Statements.

NSDL e-Gov Return Preparation Utility RPU based on JAVA platform is a freely downloadable utility. File Validation Utility FVU. The consolidated file also.

Go to View Default Summary under Defaults to see the defaults available for the particular Financial Year and Quarter. Online Correction Request Flow Submit Correction Requestcontd Enter correct. TDS REVISED RETURN CORRECTION COMPLETE PROCESS - YouTube.

The e Tutorial has been given below. Correction statements Import the saved correction or consolidated TDS TCS file Prepare the correction file Create the file Note- the option to save the Regular Correction file is also available in order to reopen the same 3. Financial Year Quarter and Form Type correction category and latest token number Request can be submitted only if.

Request number will be generated. To make the process easy as well as correct credit in Form 26AS of the deductees deductor should remove the shortfalls if any in the accepted regular TDSTCS statement by filing a correction statement. Check the defaults raised for the quarter after the regular statement is filed.

Go to Request for correction under Defaults by entering relevant Quarter Financial Year Form Type Latest Accepted Token number. How to file tds revised return online Online Correction or Add Challan on Traces. How to file tds revised return online Online Correction or Add Challan on Traces - YouTube.

This is necessary so that the data structure of e-TDS returns is compatible with the departmental application software for processing the same. Also online and offline correction and some things which you need to know. Request will be available under Track Correction Request.

Login to TRACES website. This video explains the whole procedure for. Preparation of e-TDS returns The e-TDS returns have to be prepared according to the data structure prescribed by e-TDS administrator.

Brief Steps for e-Tutorial Online Correction Pay 220 Interest Levy Late Filing. To revise the TDS returns the most important requirement is the consolidated file and the justification report. E-Filing of TDS Returns.

The material contained in the ensuing slides is for general information compilation and the views of the speaker and is purely for general discussion at the seminar and it should not be construed and binding either on the part of the Speaker or the InstituteStudy Circle. Checking can be possible through Quarterly Statement Status after 3 working days of return filing. Online Correction Request Flow Submit Correction Requestcontd click on Submit Request to raise the request Enter correct.

This feature enables deductor to set off Interest Late filing default. To view the details of the default click on the Quarter. Steps for Online Correction Return filing.

For example If deductor wants to set off Interest and late filing default with a challan having available balance which is. Correction statements Import the saved correction or consolidated TDS TCS file Prepare the correction file Create the file Note- the option to save the Regular Correction file is also available in order to reopen the same. TDS Returns are required to be revised by filing CORRECTION when some error is noticed in the filied TDS Return.

If playback doesnt begin shortly try. Here in this post we will discuss the Step by step guide for TDS correction return filing. Check the defaults raised for the quarter after the regular statement is filed.

E Tutorial On Online Tds Tcs Challan Correction

How To File Revised Tds Return Procedure

E Tutorial On Online Tds Tcs Challan Correction

Traces How To Register Login On Tds Traces Website Paisabazaar

Traces How To Register Login On Tds Traces Website Paisabazaar

E Tutorial On Online Tds Tcs Challan Correction

10 Tds Return Correction Process Online With Live Exp Youtube

How To File A Revised Tds Return On Traces Portal

Online Correction Of Tds Tcs Statement At Traces Sag Infotech

Tds Online Correction Add Modify Dedcutee Details Youtube

Traces Modify Deductee Details In Tds Return Learn By Quickolearn By Quicko

Posting Komentar untuk "E Tutorial For Tds Correction Return"