E Tutorial Tds

Guide available on the screen can be referred for valid combinations. How to e file TDS return.

E Tutorial On Online Tds Tcs Challan Correction

E tutorial tds on property 1.

E tutorial tds. TDS on property As per Finance Bill of 2013 TDS is applicable on saleof immoveable property wherein the saleconsideration of the property exceeds or is. Fill all the details and define the amount after which TDS will be in effect. Payment by using the hard copy of the challan at the designated bank.

Guidelines for installing NSDL e-Gov RPU cont Click to open RPU. NSDL e-Gov Return Preparation Utility RPU based on JAVA platform is a freely downloadableutility. Click on e-tutorials in quick links and New FAQs.

JRE Java Run-time Environment versions. ETutorial TDS on sale of propertyJune 1 2013NSDL e-Governance Infrastructure LimitedTax Information Network of Income TaxDepartment managed by NSDL 2. Setting Allocating TDS Type.

It is not mandatory to use NSDL e-Gov RPU for preparation of quarterly TDSTCS Statements. It is not mandatory to use NSDL e-Gov RPU for preparation of quarterly TDSTCS Statements. Go to home page on TRACES.

Step-2 After login Go to TDS then click on Upload TDS option. The antenna factor the frequency-dependent transfer function that converts the output from the remote unit in dBm to an H-field in dBAm or an E-field in dBVm is made available with the calibration certificate of each TDS probe. Vishal Kumar Wilson Created Date.

Inse ca you are unable to install RPU contact TIN call center at 020-2721 8080 or send e-mail to tininfonsdlcoin. Entities both corporate and non-corporate deductors making payments specified under Income Tax Act to third parties deductees are required to deduct tax at source Tax Deducted at Source -TDS from these payments and deposit the same at any of the designated branches of banks authorised to collect taxes on behalf of Government. FAQs are frequently asked question by the user.

E tutorial tds on property 1. For Form 24Q 26Q 27Q 27EQ Regular Correction for Financial Year 2007-08 onwards. NSDL e-Gov Return Preparation Utility RPU based on JAVA platform is a freely downloadable utility.

The e-TDSTCS RPU is a Java based utility. There are three types of user groups. NSDL e-Gov Internal use only.

Maximum of 3 distinct valid PANs and corresponding amount must be entered. For Form 24Q 26Q 27Q 27EQ Regular Correction for Financial Year 2007-08 onwards. Step-1 Visit the Income Tax Department website and click on LoginEnter your login credentials.

Go to the Setup TDS Type window to create a new TDS Type as shown in the picture below. 18 update 60 should be installed on the computer where the e-TDS. NSDL e-Gov Internal use only eTutorial TDS on sale of property NSDL e-Governance Infrastructure Limited Tax Information Network of Income Tax Department managed by NSDL Confidential.

Slideshare uses cookies to improve functionality and performance and to provide you with relevant advertising. You can change your ad preferences anytime. Basically the TDS system can be regarded as a miniature broad-band optically isolated antenna.

ETutorial TDS on sale of propertyJune 1 2013NSDL e-Governance Infrastructure LimitedTax Information Network of Income TaxDepartment managed by NSDL 2. NSDL e-Gov Internal use only. Then attach the signature file generated using DSC.

E-Tutorials are a step-by-step guide to various functionalities provided by TRACES. In this part you can gain knowledge about various provisions relating to e-payment of direct taxes. Amount should be entered in two decimal placeseg123456 Only Valid PANs reported in the TDSTCS statement corresponding to the CINBIN detailsin Part1 must be entered in Part2 of the KYC.

This tutorial will guide you to the process of entering TDS details and its calculations at the time of entering purchase in Logic ERP. Used for preparing quarterly e-TDSTCS Statements. And ii e-payment mode ie.

TDS on property As per Finance Bill of 2013 TDS is applicable on saleof immoveable property wherein the saleconsideration of the property exceeds or is. 16 onwards up to JRE. Step-4 Upload the TDS zip file prepared using the utility downloaded from tin-NSDL Website.

We use your LinkedIn profile and activity data to personalize ads and to show you more relevant ads. TRACES TDS-CPC has enabled filing Form 26B for online request for refund of excess TDS deposited. E-payment of direct taxes There are two modes of payment of direct taxes i physical mode ie.

E-Tutorial TDS on sale of property Contents updated on January 27 2017. Step-3 Next enter the Statement details and click on Validate. Making payment by using the electronic mode.

This was the much awaited and highly anticipated change. RPUAVA is a J based utility so kindly make sure that latest JAVA version is installed on your respective machines. The Transcript Delivery System TDS allows users to request federal tax information from IRS records on behalf of taxpayers and their designees.

The requests can be viewed online and printed sent to your secure mailbox mailed or faxed. Used for preparing quarterly e-TDSTCS Statements.

E Tutorial On Online Tds Tcs Challan Correction

E Tutorial On Online Tds Tcs Challan Correction

Tds Meter Using Tds Temperature Sensor With Arduino Measure Water Quality In Ppm Youtube

Tutorial Cara Penggunaan Tds Ec Meter Indonesia Youtube

Penggunaan Tds Ec Meter Peralatan Hidroponik

Https Www Tin Nsdl Com Downloads E Tds Java 20rpu 20e Tutorial 20version 201 207 204 Pdf

E Tutorial On Online Tds Tcs Challan Correction

E Tutorial Online Correction Pay 220 Interest Levy Late Filing

Https Www Tin Nsdl Com Downloads E Tds Java 20rpu 20e Tutorial 20version 201 207 204 Pdf

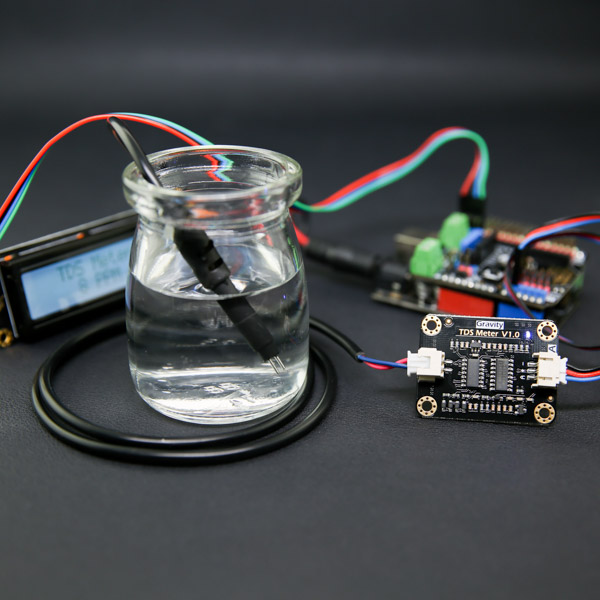

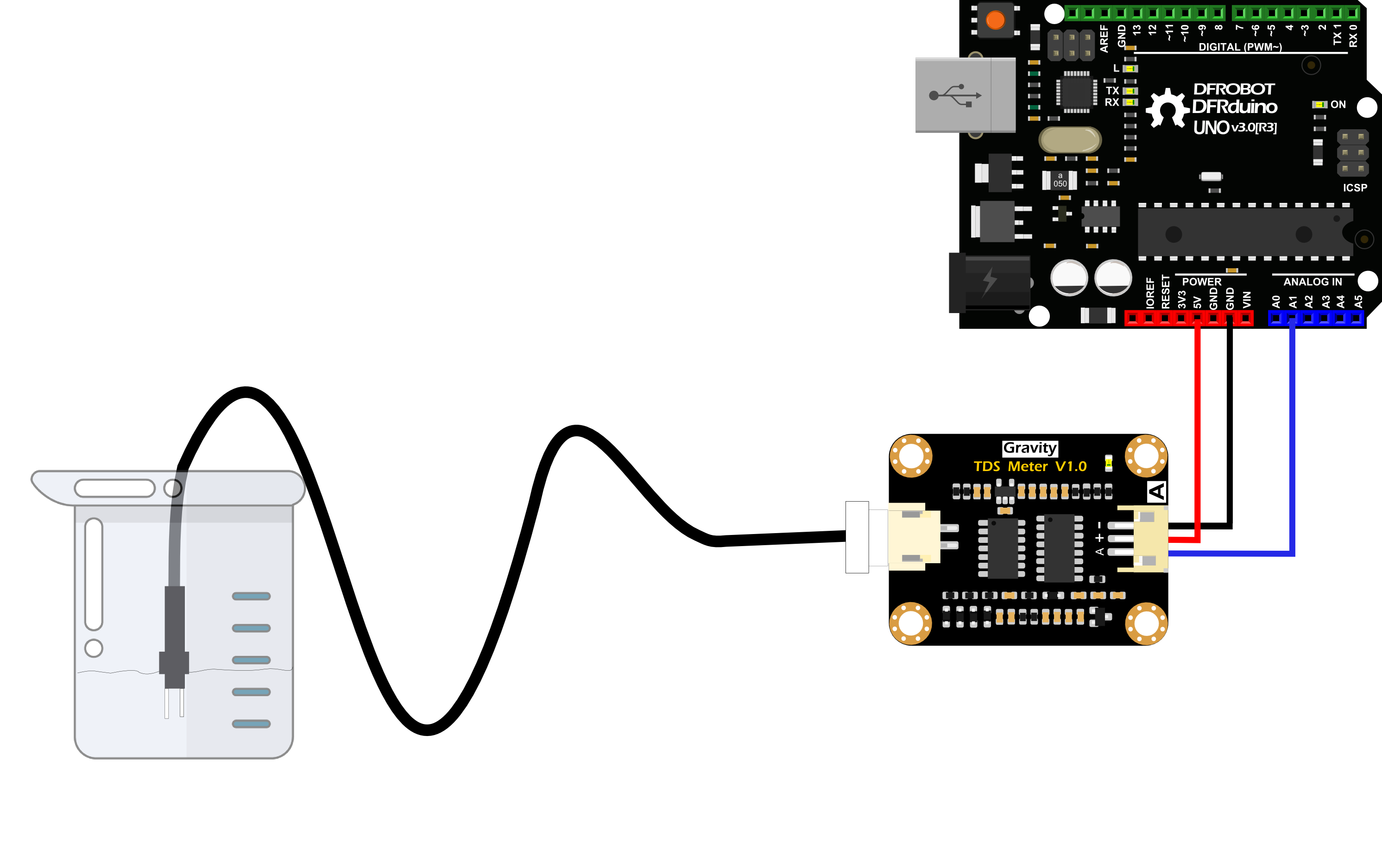

Gravity Analog Tds Sensor Meter For Arduino Sku Sen0244 Dfrobot

Gravity Analog Tds Sensor Meter For Arduino Sku Sen0244 Dfrobot

Posting Komentar untuk "E Tutorial Tds"